The EUR/USD pair experienced consolidation for the most part of last week’s trading, despite maintaining its bullish momentum, as highlighted in our previous weekly technical analysis.

The 1.10422 supply/resistance level seems to be holding the price nicely, but the question remains: can this resistance level, tested multiple times, continue to resist the price from continuing its uptrend?

Let’s delve into the EUR/USD analysis for daily, 4-hour, and 1-hour chart timeframes in more detail to answer this question.

| Key Takeaways |

|---|

| EUR/USD Consolidation: Despite maintaining its bullish momentum, the EUR/USD pair exhibited significant consolidation over the past week, with the 1.10422 supply/resistance level holding strong. |

| Uptrend Remains Intact: The current uptrend is still evident in the daily, 4-hour, and 1-hour timeframes, with price rejecting from the 20-day EMA and MACD above the zero line. |

| Potential Retest of Support: The 4-hour chart suggests the likelihood of price retesting the 1.09098 support level due to weak upward momentum indicated by the MACD. |

| Shift in Momentum on 1-hour Timeframe: The 1-hour timeframe indicates a shift in momentum, with the MACD below the zero line. This, combined with consolidation on the 4-hour timeframe, suggests that price action may move sideways for some time, barring any major news events. |

| Factors Affecting EUR/USD Next Week: Key factors to watch for next week include monetary policy decisions by the ECB, inflation data, market confidence and sentiment, and overall economic growth. |

| GBP/USD Range-bound Trading Opportunities: The GBP/USD pair has been trading within a range, with resistance around 1.4000 and support around 1.3800. Traders can look for potential range-bound opportunities by buying near support and selling near resistance. |

| Economic Calendar and Potential Volatility: A series of economic events and data releases, such as the ECB’s monetary policy decisions, ISM Manufacturing and Services PMI, and U.S. employment figures, could cause price volatility in the coming week. |

| Fed Rate Hike Anticipation: Many speculators believe that the Fed will halt interest rate hikes after the May 3rd decision, which may affect the EUR/USD pair’s movement. |

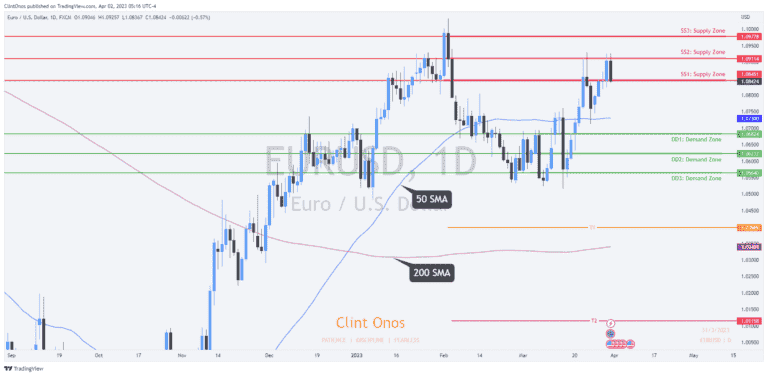

EUR/USD Analysis Daily Chart

On the EUR/USD daily chart, there isn’t much change in the view from last week. The trend is clearly in an uptrend at the moment, confirmed by the price rejecting the 20-day EMA and the MACD remaining above the zero line.

The 1.09098 demand/support level from April 17th, 2023, seems sufficient enough to keep the price action moving upward. However, it’s unclear how long this will last if the level is invalidated.

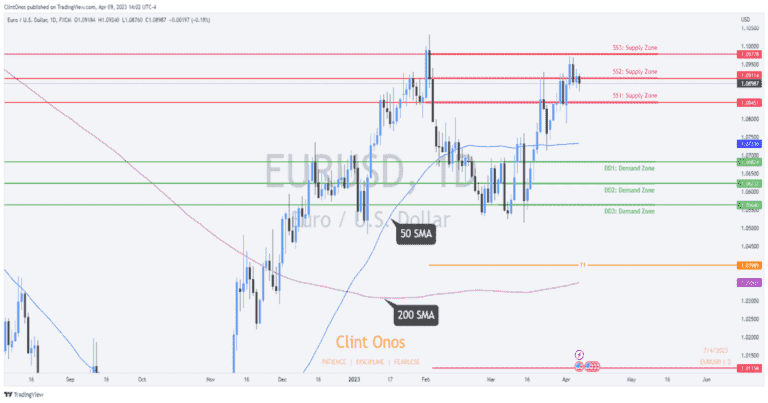

EURUSD 4-Hour Chart

The EUR/USD pair’s consolidation seen on the daily chart is even clearer on the 4-hour chart, with the price ranging between the April 17th low of 1.09091 and the April 26th high of 1.10956, 2023.

The price danced around the 20-period EMA within the range levels identified. Although the price is in an uptrend, there is a likelihood of a retest at the 1.09098 support level, as the MACD shows weak upside momentum.

The trendline connecting the April 10th higher low and April 28th potential higher low might just be the key.

EUR/USD 1-Hour Chart

The 1-hour timeframe suggests a shift in momentum, with the MACD clearly below the zero line. Combining this fact with the consolidation observed on the 4-hour timeframe, price action might likely move sideways for some time, except in the case of a major news event such as the Fed rate hike expected on May 3rd, 2023. It is unclear if this will be the last rate hike, but many speculators believe the Fed will halt interest rate hikes after the May 3rd decision.

Factors That Could Affect the EUR/USD Chart Next Week

Several factors could potentially affect the EUR/USD chart next week. One of the key factors is monetary policy, particularly any decisions made by the ECB regarding interest rates. Inflation is another crucial factor that could influence the currency pair rate, as it reflects the health of the economy.

Confidence and sentiment in the market can also affect the currency pair rate. Additionally, economic growth is another vital factor that could impact the rate of the EUR/USD currency pair.

The GBP/USD pair has been trading within a range for the past few weeks, with resistance around 1.4000 and support around 1.3800. Traders can look for potential range-bound opportunities by buying near support and selling near resistance.

However, if the pair breaks below the support level, it could indicate a bearish trend, and traders may want to consider short positions. On the other hand, if the pair breaks above resistance, it could indicate a bullish trend, and traders may want to consider long positions.

News Events That Might Cause Price Volatility

Below are some of the news events that might cause price volatility next week:

- May 1: French, German, and Italian Bank Holidays, and USD ISM Manufacturing PMI

- May 2: EUR CPI Flash Estimate y/y, EUR Core CPI Flash Estimate y/y, and USD JOLTS Job Openings

- May 3: USD ADP Non-Farm Employment Change, USD ISM Services PMI, USD FOMC Statement, and USD Federal Funds Rate

- May 4: EUR Main Refinancing Rate, EUR Monetary Policy Statement, USD Unemployment Claims, and EUR ECB Press Conference

- May 5: USD Average Hourly Earnings m/m, USD Non-Farm Employment Change, and USD Unemployment Rate

For more information on these events, check the following sources:

- EUR/USD Forecast: This Will Make or Break Your Trades

- EUR/USD Forecast: Supply and Demand in Forex Trading

- EUR/USD Bullish Outlook Still Strong

Final Thought on EUR/USD Analysis

Traders should keep a close eye on the EUR/USD pair, as the consolidation observed on various timeframes suggests potential volatility in the coming weeks. Major news events, such as the Fed rate hike and other economic data releases, will likely play a significant role in determining the future direction of the currency pair.

As the famous investor Warren Buffett once said,

The most important quality for an investor is temperament, not intellect. You need a temperament that neither derives great pleasure from being with the crowd or against the crowd.

By staying informed and maintaining a calm, rational approach to trading, investors can increase their chances of success in the ever-changing world of Forex.