You’ve probably heard the saying, “Don’t put all your eggs in one basket.” Well, that’s the name of the game in forex trading—risk management. The forex market is a wild roller-coaster ride, and if you don’t manage your risk properly, you might end up flat on your face.

In this comprehensive guide, we’ll cover the importance of position sizing in forex trading, the ins and outs of using a Position Size Calculator, and practical tips for incorporating this powerful risk management tool into your trading strategy.

So, buckle up, and let’s dive right in!

| Key Takeaways |

|---|

| 1. Understand the importance of risk management and position sizing in forex trading. |

| 2. Learn how the Position Size Calculator works and the factors to consider when selecting one. |

| 3. Choose a user-friendly and customizable calculator that’s compatible with your trading platform. |

| 4. Incorporate the calculator into your trading setup and use it in conjunction with other technical analysis tools and platforms. |

| 5. Combine the Position Size Calculator with other trading tools and strategies for optimized trade entries and exits. |

| 6. Regularly review and adjust your position sizes based on your account balance, market volatility, and risk tolerance. |

| 7. Apply the Position Size Calculator consistently for effective risk management and long-term success. |

| 8. Continuously refine your risk management strategy and position sizing calculations based on changing market conditions. |

What is forex trading risk management?

Forex trading, or foreign exchange trading, involves buying and selling currencies in the global market. The forex market is the largest and most liquid financial market in the world, with an average daily trading volume of over $6 trillion.

When it comes to risk management, it’s crucial to understand that trading, by nature, is inherently risky. However, by implementing a proper risk management strategy, you can minimize potential losses and protect your trading capital.

Importance of position sizing in Forex trading

Position sizing is a critical component of risk management. It refers to the number of units or contracts you trade in a single transaction. Proper position sizing can help you:

- Limit your exposure to risk

- Avoid over-leveraging your account

- Maintain a balanced and diversified portfolio

- Preserve your trading capital in the long run

Position Size Calculator as a risk management tool

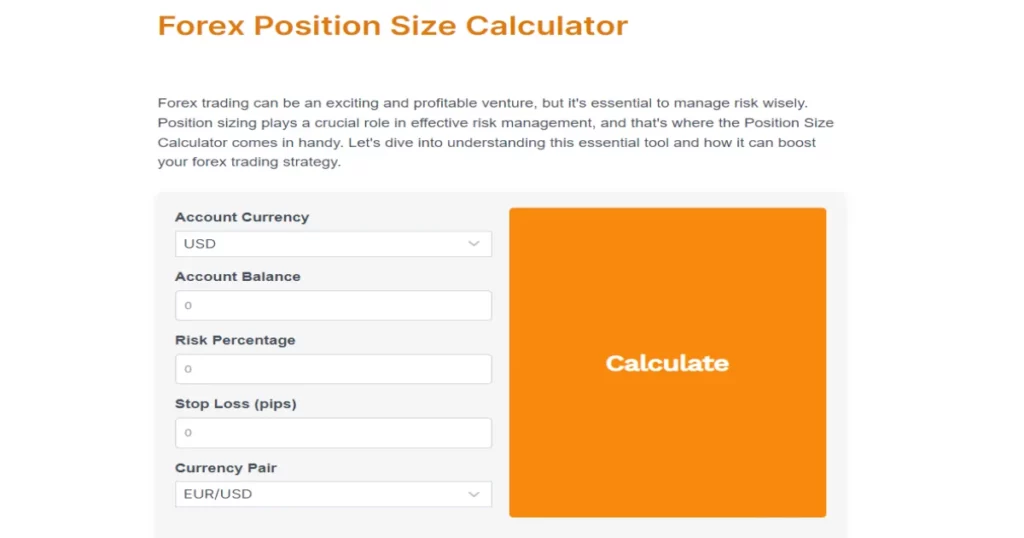

A position size calculator is a handy tool that can help you determine the ideal trade size based on your account size, risk tolerance, and other factors. By using a position size calculator, you can ensure that you’re trading within your risk parameters and safeguarding your capital from potential losses.

How the Position Size Calculator Works

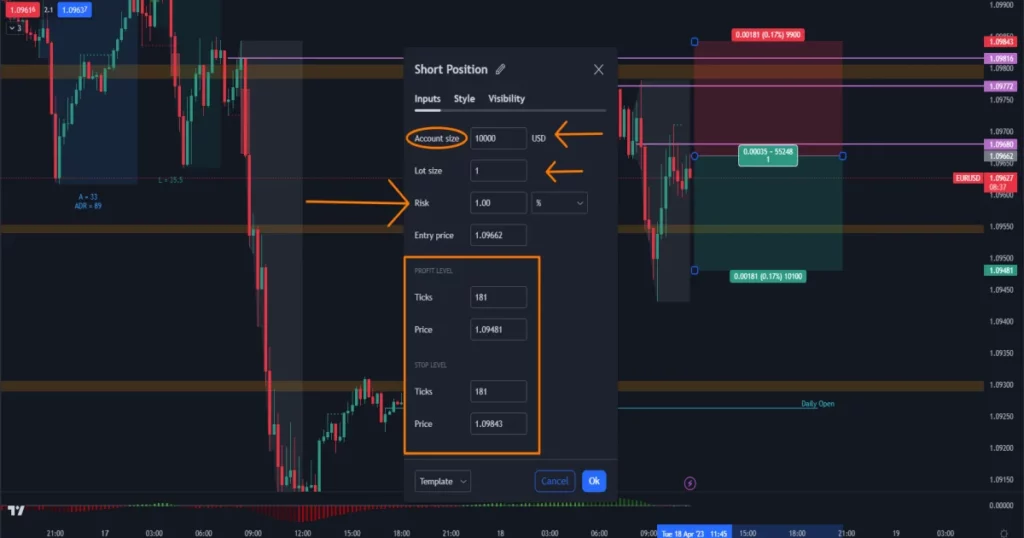

A position size calculator takes into account your account balance, risk percentage, and stop-loss level to calculate the ideal position size for a trade. The formula is as follows:

Position Size = (Account Balance x Risk Percentage) / (Stop Loss in Pips x Pip Value)

The calculator will output the position size in units or lots, depending on your preference.

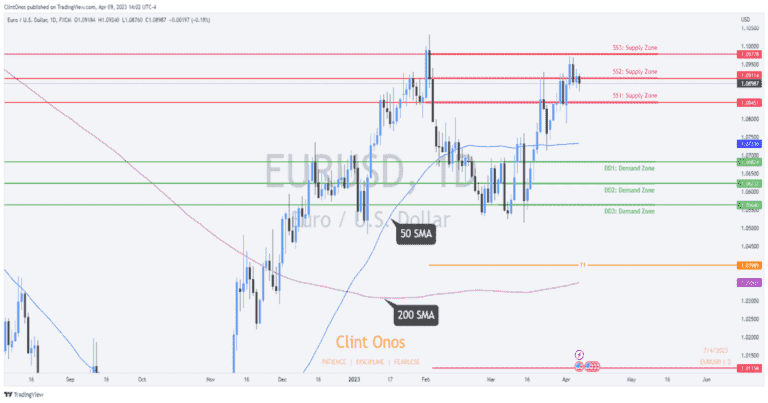

Calculating position sizes for various currency pairs and account types

Different currency pairs and account types require different position size calculations. For instance, the pip value for a standard lot (100,000 units) of EUR/USD is $10, while the pip value for a mini lot (10,000 units) is $1. To accurately calculate position sizes, you’ll need to consider the currency pair and account type you’re trading.

Here’s a quick example:

Let’s say you have an account balance of $10,000, and you’re willing to risk 1% of your account on each trade. If you’re trading the GBP/USD pair with a stop-loss distance of 50 pips, the Position Size Calculator would determine that you should invest approximately $20 per pip. This way, if the market moves against you by 50 pips, you’d only lose $1,000 or 1% of your account balance.

Factors to consider when selecting a Position Size Calculator

When choosing a position size calculator, consider the following factors:

- Ease of use: The calculator should be user-friendly and easy to navigate

- Customization options: The calculator should allow you to input your own risk parameters and account details

- Compatibility: The calculator should be compatible with your trading platform and devices

Understanding the Position Size Calculator in Forex Trading

Before we get too far ahead of ourselves, let’s break down how the Position Size Calculator actually works. At its core, this handy tool takes into account your account balance, trade risk, and stop-loss distance to calculate the ideal position size for each trade. By doing so, it helps you keep your risk in check and prevents you from making costly mistakes.

Position Size Calculator variables

As we mentioned earlier, the Position Size Calculator factors in three main variables:

- Account Balance: This is the total amount of money in your trading account.

- Trade Risk: This is the percentage of your account balance that you’re willing to risk on each trade.

- Stop-Loss Distance: This is the difference between your entry price and the price at which you’d exit the trade if the market moves against you.

By inputting these variables into the calculator, you’ll receive an output in the form of your ideal position size. This way, you can ensure that you’re not overexposing yourself to risk and that you’re staying within your pre-determined trading parameters.

Integrating the Position Size Calculator into Your Forex Trading Strategy

Combining the Position Size Calculator with other trading tools and platforms

The Position Size Calculator is a powerful tool, but it works best when combined with other trading tools and platforms.

For instance, you can integrate it with your live forex trading platform, technical analysis tools, and fundamental analysis resources. By doing so, you can create a well-rounded trading strategy that factors in position sizing, market analysis, and risk management.

Optimizing trade entries, exits, and diversification using a Position Size Calculator

The Position Size Calculator can help you optimize your trade entries and exits by determining the ideal position size based on your risk tolerance and account size. This way, you can minimize the risk of overexposure and increase the potential for profit.

Moreover, using a Position Size Calculator can help you diversify your trades by allocating your risk across different currency pairs, thus reducing the impact of a single trade going against you.

Adjusting position sizes based on volatility, currency correlation, and risk tolerance

Market conditions are ever-changing, and adjusting your position sizes according to current market volatility, currency correlation, and your risk tolerance is crucial.

The Position Size Calculator allows you to make these adjustments quickly and efficiently, ensuring that you maintain a balanced trading portfolio.

Applying the Position Size Calculator for Consistent Risk Management

Maintaining a consistent risk management approach

Using a Position Size Calculator helps you maintain a consistent risk management approach by providing you with the optimal position size for each trade based on your predetermined risk parameters.

This consistency enables you to manage your trades effectively, reduce emotional decision-making, and ultimately increase your chances of long-term success in the forex market.

Handling currency conversion, leverage, and risk/reward ratios

When trading forex, you need to consider currency conversion rates, leverage, and risk/reward ratios.

A Position Size Calculator can help you handle these factors efficiently by providing you with accurate position size calculations that take into account the specific details of your trades. By doing so, you can ensure that your trades align with your overall risk management strategy.

Managing trading emotions and building a well-rounded trading plan

Emotions can be a trader’s worst enemy. By using a Position Size Calculator to determine your ideal position sizes, you can minimize the impact of emotions on your trading decisions.

Moreover, incorporating a Position Size Calculator into a well-rounded trading plan can help you build discipline and consistency in your trading approach, which are essential for long-term success in the forex market.

Practical Tips for Using a Position Size Calculator in Forex Trading

Selecting the right Position Size Calculator for your trading style

As mentioned earlier, choosing the right Position Size Calculator for your trading style is crucial. To do this, consider factors such as ease of use, compatibility with your currency pairs and account type, and customization options.

Monitoring your portfolio and making adjustments based on market conditions

Using a Position Size Calculator is an ongoing process that requires regular monitoring of your portfolio and making adjustments based on market conditions. Keep an eye on the performance of your trades and make necessary changes to your position sizes as needed, ensuring that you continue to manage risk effectively.

Reviewing your risk management strategy periodically

It’s essential to review your risk management strategy periodically and make adjustments as your trading goals, risk tolerance, and market conditions change. By regularly evaluating your strategy and making appropriate changes, you can continue to use the Position Size Calculator effectively and maintain a well-balanced trading approach.

Keeping a trading journal to track your position sizing decisions

A trading journal is a valuable tool for any forex trader, as it allows you to track your trading decisions, including position sizing, and analyze your performance over time. By keeping a detailed record of your position sizing decisions, you can learn from your experiences and refine your risk management strategy, ultimately leading to improved trading performance.

Conclusion – It’s your turn!

The Position Size Calculator is a valuable tool for forex traders that can help you manage risk and maintain a diversified portfolio. By using the calculator to determine the appropriate position size for each trade, you can minimize the impact of losses and maximize your profits in the long run.

To fully integrate the Position Size Calculator into your forex trading strategy, consider the following steps:

- Choose a user-friendly and customizable calculator that’s compatible with your trading platform.

- Incorporate the calculator into your trading setup and use it in conjunction with other technical analysis tools and platforms.

- Regularly review and adjust your position sizes based on your account balance, market volatility, and risk tolerance.

By doing so, you can improve your trading performance, increase your chances of success, and make the most of your forex trading endeavors.