If you’re a forex trader, then you’re probably already aware of the EURUSD pair. It’s one of the most popular currency pairs in the market, and for good reason.

However, the EURUSD pair’s recent price action has left many traders scratching their heads, wondering what’s next for the pair.

In this article, we’ll take a look at the technical analysis of the EURUSD pair, and what traders can expect in the coming week.

Lack of Momentum to the Upside: Pull-Back Likely

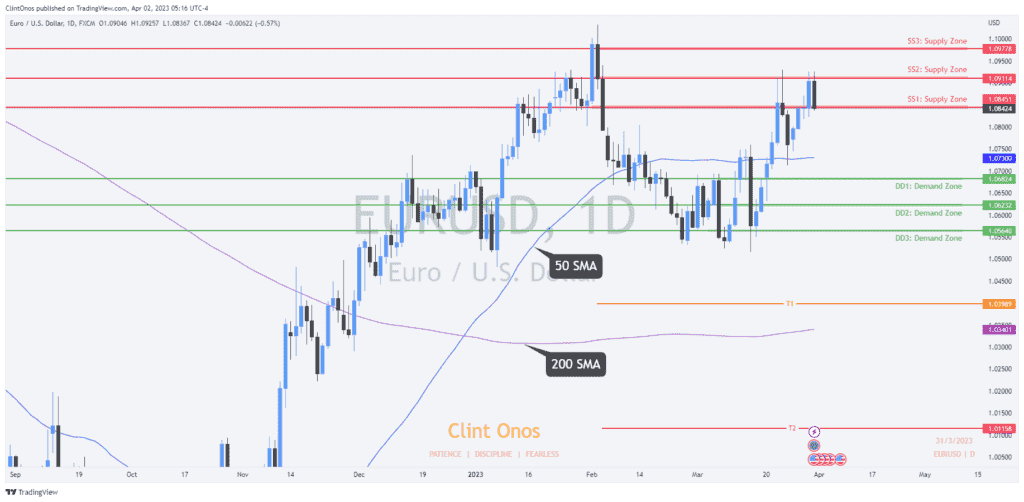

The EURUSD pair daily chart again shows a lack of momentum to the upside. As stated in our previous weekly analysis for the EU pair, pull-back is likely to gauge the potential of uptrend continuation.

The EURUSD currency pair traded to the upside last trading week without our anticipated retracement or pull-back. The 50-SMA no doubt provided the needed support after a break above and daily candle closing at 1.07653 on Tuesday 21st March 2023.

The uptrend move, however, couldn’t sustain pressure as the pair met resistance at the previous supply zone of 1.09114.

Based on the price rejection at the 1.09114 Supply zone and price closing below 1.08424 on Friday 31st March 2023, there is the likelihood of price trading back to first demand zones at 1.06824, 1.6232, and 1.05640.

If any of these demand zones could not hold the price of the EURUSD currency pair, then we can anticipate the price to reach target one at around 1.03989.

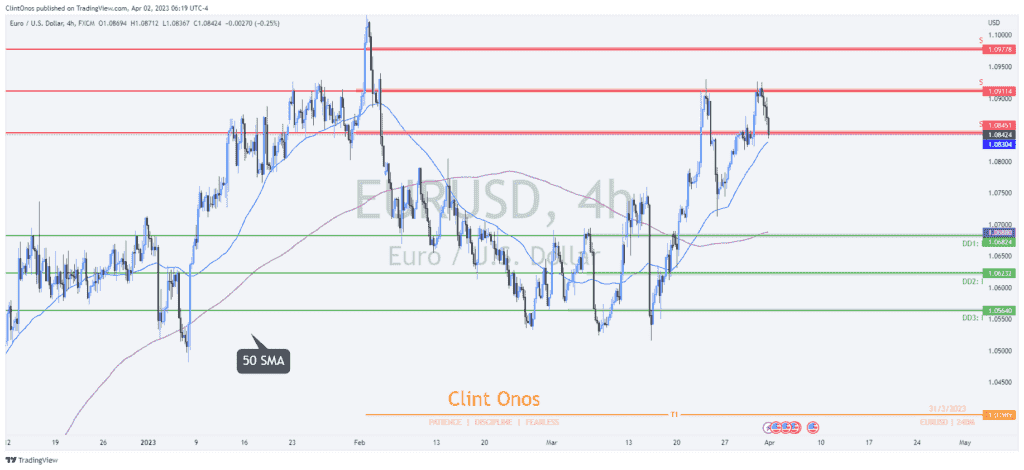

Double Top Reversal Pattern on the 4-hour Chart

Also, on the 4-hour chart, we can clearly see the EURUSD pair already forming a double-top reversal pattern.

If the price closes below the 50-SMA, then we can expect the price to trade easily to the first demand zone and the 200-SMA.

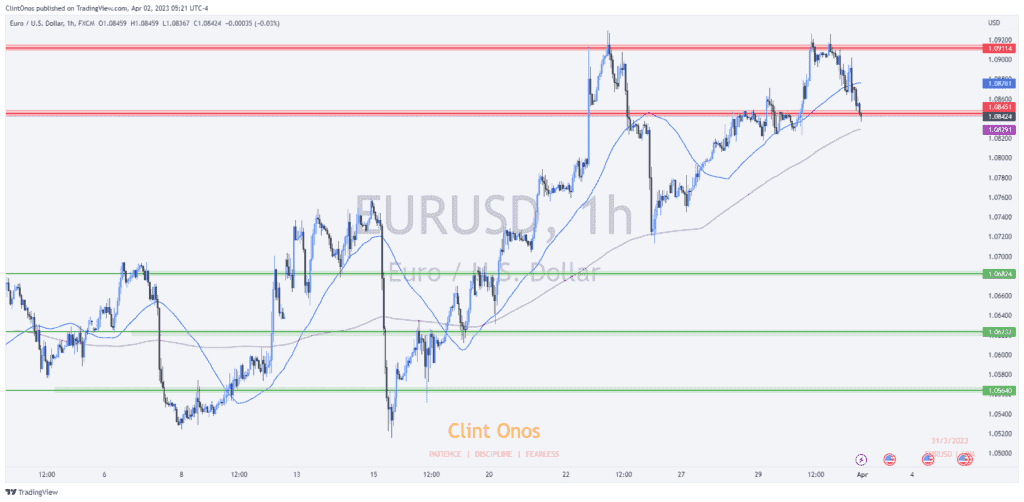

Bearish Signal on the 1-hour Chart

If we zoom in further to the 1-hour chart, it is even clearer as the EURUSD pair price already closed below the 50-SMA and trading near the 200-SMA.

US Dollar Volatility and High-Impact News

There is not much high-impact news from the euro zone in the coming week that can result in high volatility. However, the US dollar is likely to be volatile considering the expected high-impact news.

Here are some key economic events to watch out for:

- Monday, April 3rd: OPEC-JMMC Meetings, ISM Manufacturing PMI, and ISM Manufacturing Prices (USD)

- Tuesday, April 4th: JOLTS Job Openings (USD)

- Wednesday, April 5th: ADP Non-Farm Employment Change (USD) and ISM Services PMI (USD)

- Thursday, April 6th: Unemployment Claims (USD)

- Friday, April 7th: Average Hourly Earnings m/m (USD), Non-Farm Employment Change (USD), and Unemployment Rate (USD)

Furthermore, the technical indicators on the daily chart show that the momentum has shifted to the downside. The RSI indicator has fallen below the 50 level, indicating a potential bearish move, while the MACD indicator has crossed below the signal line, further confirming the bearish bias.

Conclusion: Bias Shifted to the Downside, Traders Should Watch Technical Indicators and High-Impact News

Based on the current technical analysis, it is clear that the EURUSD pair is likely to face some volatility in the coming week.

The lack of momentum to the upside and the potential for a pull-back suggest that traders should be cautious in their approach.

The formation of a double-top reversal pattern and the proximity to the 200-SMA also indicate that the price could potentially trade lower.

It is essential to keep an eye on the upcoming economic events, particularly those related to the US dollar, as they could have a significant impact on the EURUSD pair’s price.

In summary, traders should exercise caution and keep a close watch on the technical and fundamental factors that could influence the EURUSD currency pair’s price movements.