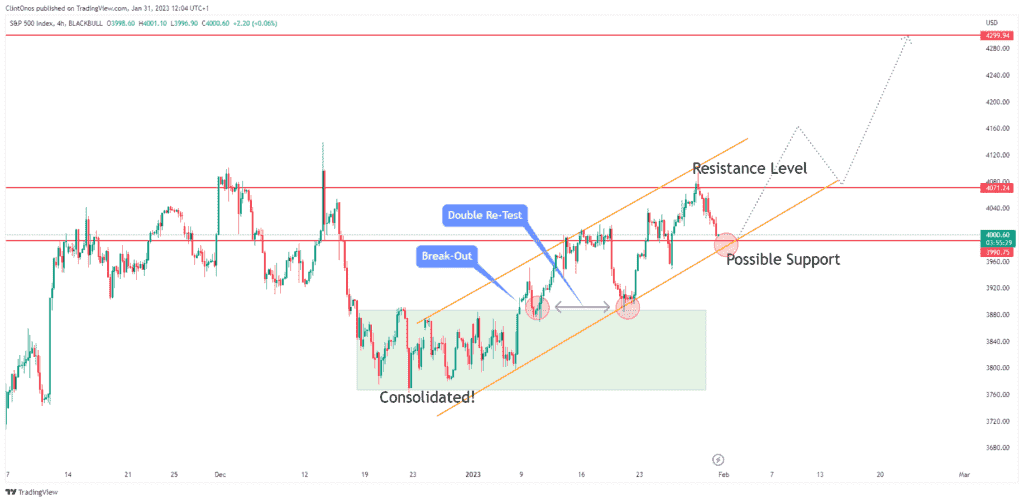

The SPX500 is currently showing an upward trend as traders await the outcome of the Federal Reserve’s interest rate hike meeting scheduled for tomorrow.

The result of the meeting is expected to have a significant impact on the price of the SPX500 asset class.

Crucial Support Level at 4000

The current price is trading at a crucial support level of 4000, which is also considered a round number and is referred to as a psychological level by many traders.

In my opinion, the correction will be short-lived, and the price will resume its bullish movement.

However, the stability of the support levels around 4000 and 3990 depends on various factors, including the Fed’s interest rate decision.

The Fed’s Decision and Market Outlook

If the Fed decides to hike rates by 25 basis points, the market is likely to adopt a bearish outlook for the US dollar.

On the other hand, if the price breaks through the support levels of 4000 and 3990, it is highly probable that the price will retest the top of the consolidation breakout for the third time.

Recommend: BTCUSDT: Bitcoin Likely to Continue Bullish After Correction

Final Thoughts on the Market Outlook

In conclusion, the SPX500 has been showing an upward trend as traders await the outcome of the Federal Reserve’s interest rate hike meeting.

The current price is trading at a crucial support level of 4000, which is also considered a psychological level by many traders.

Although the stability of the support levels depends on various factors, including the Fed’s interest rate decision, it’s expected that any correction will be short-lived, and the price will resume its bullish movement.

The Fed’s decision to hike rates by 25 basis points is likely to have a significant impact on the market outlook.

If the Fed hikes rates, the market may adopt a bearish outlook for the US dollar, which could lead to a decline in the SPX500.

On the other hand, if the price breaks through the support levels of 4000 and 3990, it is highly probable that the price will retest the top of the consolidation breakout for the third time.

Traders and investors are advised to monitor the market closely and adjust their positions accordingly based on the outcome of the Fed meeting and the price movements of the SPX500.

The current market conditions are highly volatile and unpredictable, which makes it crucial to implement risk management strategies and trade with caution.

In summary, it’s essential to keep a close eye on the levels discussed above and to remain updated with the latest market news and events to make informed trading decisions.

By doing so, traders and investors can navigate the market effectively and potentially achieve their financial goals.