The forex market is the biggest financial market in the world. It is also one of the riskiest markets to trade in. A 2013 report from the Bank for International Settlements showed that the forex market averaged $5 trillion in daily trading volume. As of today, we can say this figure has increased significantly. Because more individual traders and financial institutions, use it to hedge risk and expand their investor base.

The profitability of any market comes from its structure and dynamics, not its size or popularity. Given that risks are high in forex and so are potential rewards. A thorough understanding of how this market works is essential for anyone planning on trading it.

In this post, I’ll show you how to trade on the Forex market as an experienced trader who can make money. You can read Forex Trading: Everything You Need To Know Now as a beginner.

What is the Forex Market?

A forex market where you can buy or sell one country’s currency for another. Traders buy and sell currencies to try to profit from changes in their exchange rates. Because the market is so large and opens 24 hours a day, seven days a week.

This is done through the use of computers and electronic communications networks (ECNs) to facilitate trade. This enables the market to be open 24 hours a day, five days a week. An average daily volume of $5 trillion translates to $1.25 billion traded every minute. Kindly read my previous post, “Forex Trader Guide: How to Be a Good Trader,” to gain more understanding.

Forex Strategies

A strategy is a well-defined approach to trading a specific type of asset. A strategy is made up of rules to engage the forex market. In forex trading, the strategy should take into account how the market is doing, what the best trading instruments are, and how to manage risk. Skilled traders will have multiple strategies that they can apply to a variety of market conditions. and should be able to shift between them seamlessly.

There are hundreds of different strategies that can be used in forex trading. But based on economic data and events, they can be put into two groups: technical and fundamental. No strategy can be sure to make money in every market situation, and every strategy comes with risks. With that said, there are some strategies that have higher success rates than others. Here are a few of the most popular strategies for forex traders.

Fundamental Analysis: Fundamental analysis is a long-term strategy that uses economic data and other indicators to determine the future direction of a currency’s price.

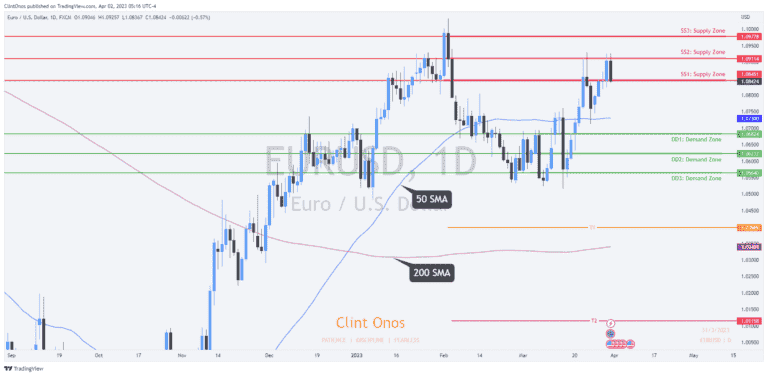

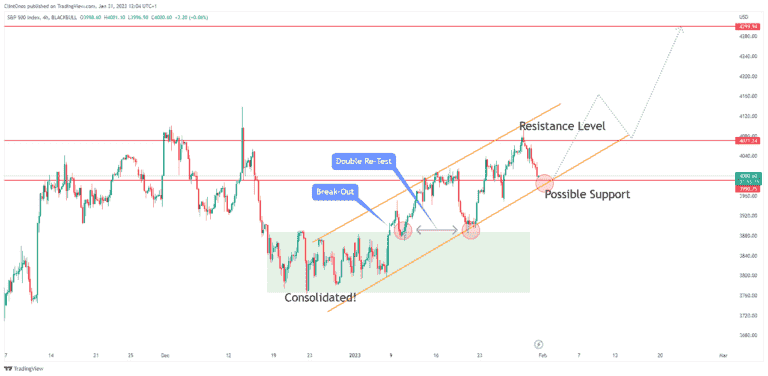

Technical Analysis: Technical analysis is a short-term strategy that uses past price movements to predict future price trends.

Risk Management in the Forex Market

As with any other financial market, trading in forex is not without its risks. Trading on margin and leveraging are two ways in which traders can multiply their potential return. However, this is not without considerable risk as well. Margin trading, in particular, is risky because it involves borrowing money (from your broker) to trade with. The greater the amount of leverage and the higher the amount borrowed, the greater the potential return on investment.

However, it also means that a small decline in the value of the investment can lead to a large decline in the value of your overall account. When trading in forex, always remember that a small decline in the value of the asset can lead to a large decline in the value of your overall account.

Forex Tools and Resources

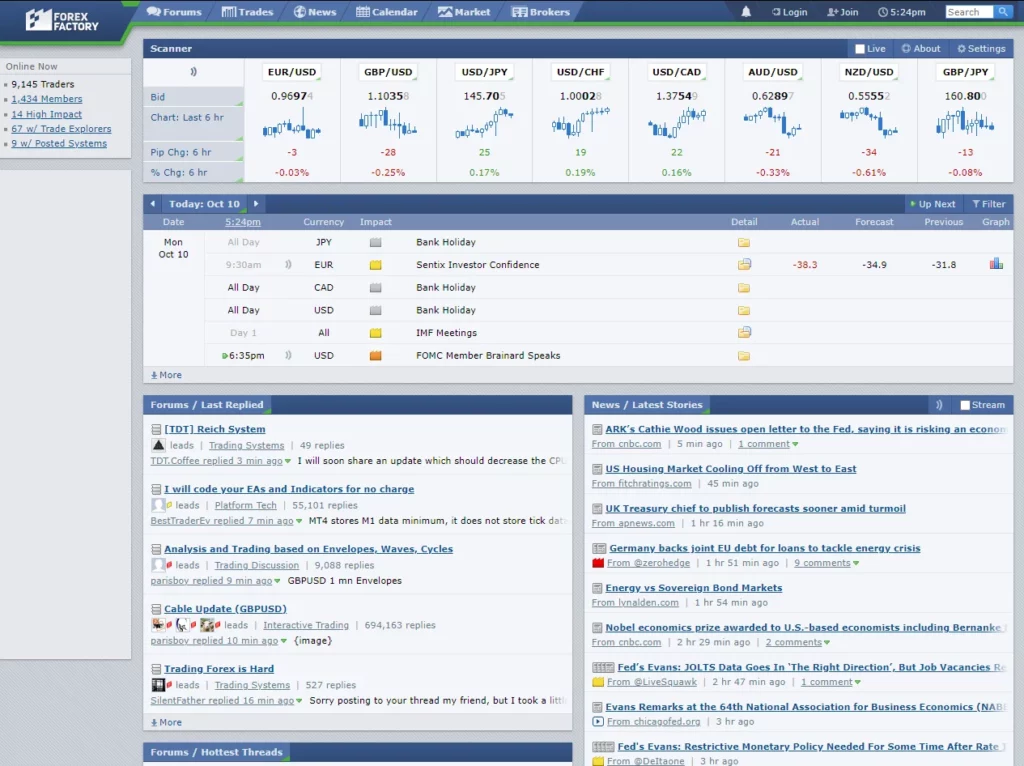

Economic data and events are the primary drivers of currency prices, so keeping track of these is essential to successful trading. Forex Factory is a great place to find useful tools and resources.

Economic indicators such as Gross Domestic Product (GDP) and consumer price inflation are used to determine the health of a country’s economy.

A trader’s trading strategy is the set of rules and plans they use to make trades.

Forex Trading Platforms: Trading platforms are the software and tools that traders use to execute their trades.

Trading and Investing Psychology: Trading and investing are challenging endeavors that require discipline, courage, and confidence.

Conclusion

The forex market is the largest financial market in the world. It is also one of the riskiest markets to trade in. A successful forex trader must understand how the market works. Be able to identify the most appropriate strategies for different market conditions, and know how to manage their risk.

What are your thoughts? Please leave a comment below. Thank you for reading this post; if you require any additional assistance or clarification, please let me know. Contact us.